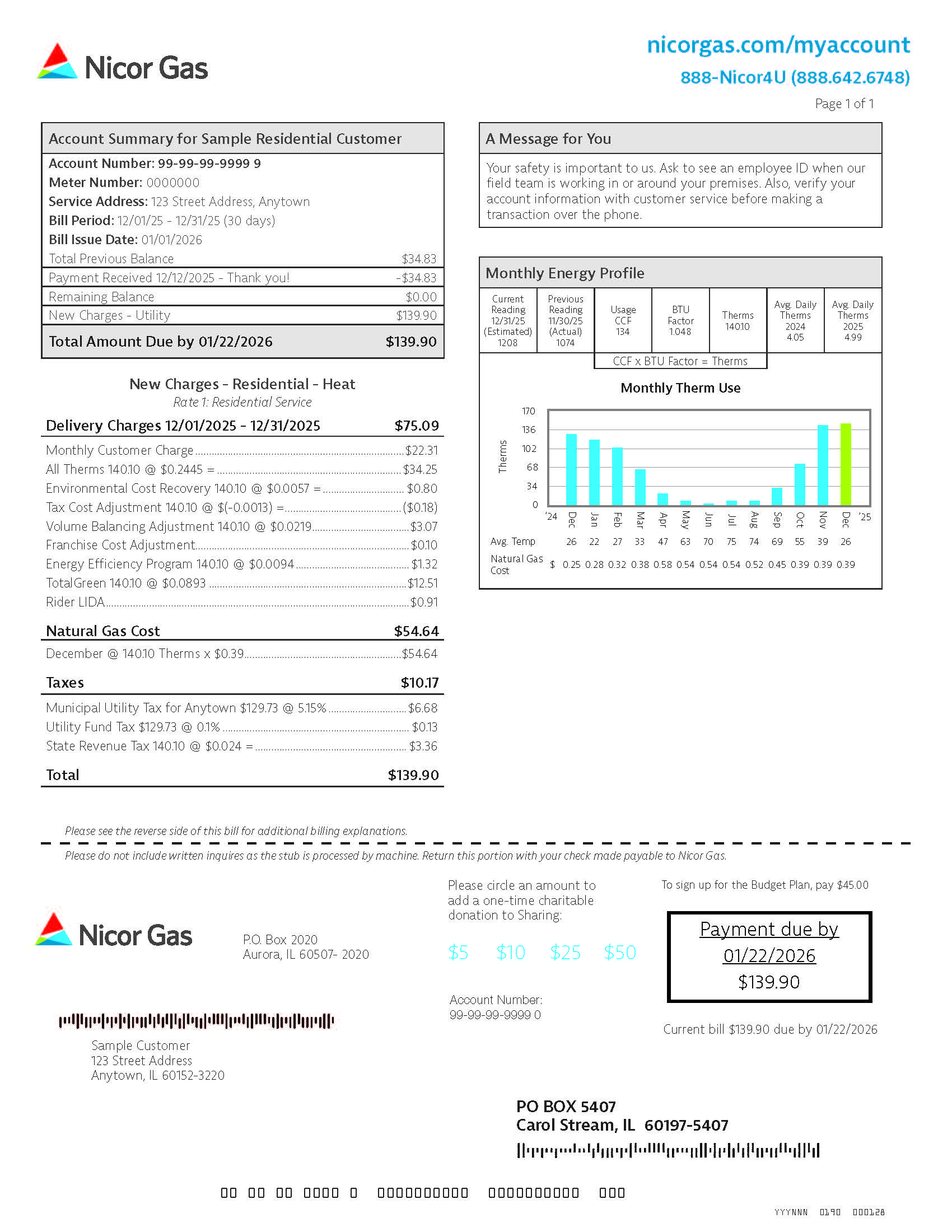

Understanding Your Bill

Whether you’re wondering what certain charges mean, or are unsure of where to find your payment due date, you’ll find those answers here. You can also find your unique account information by logging into My Account. Take a look at the detailed invoice information below.

Text should only be visible on mobile

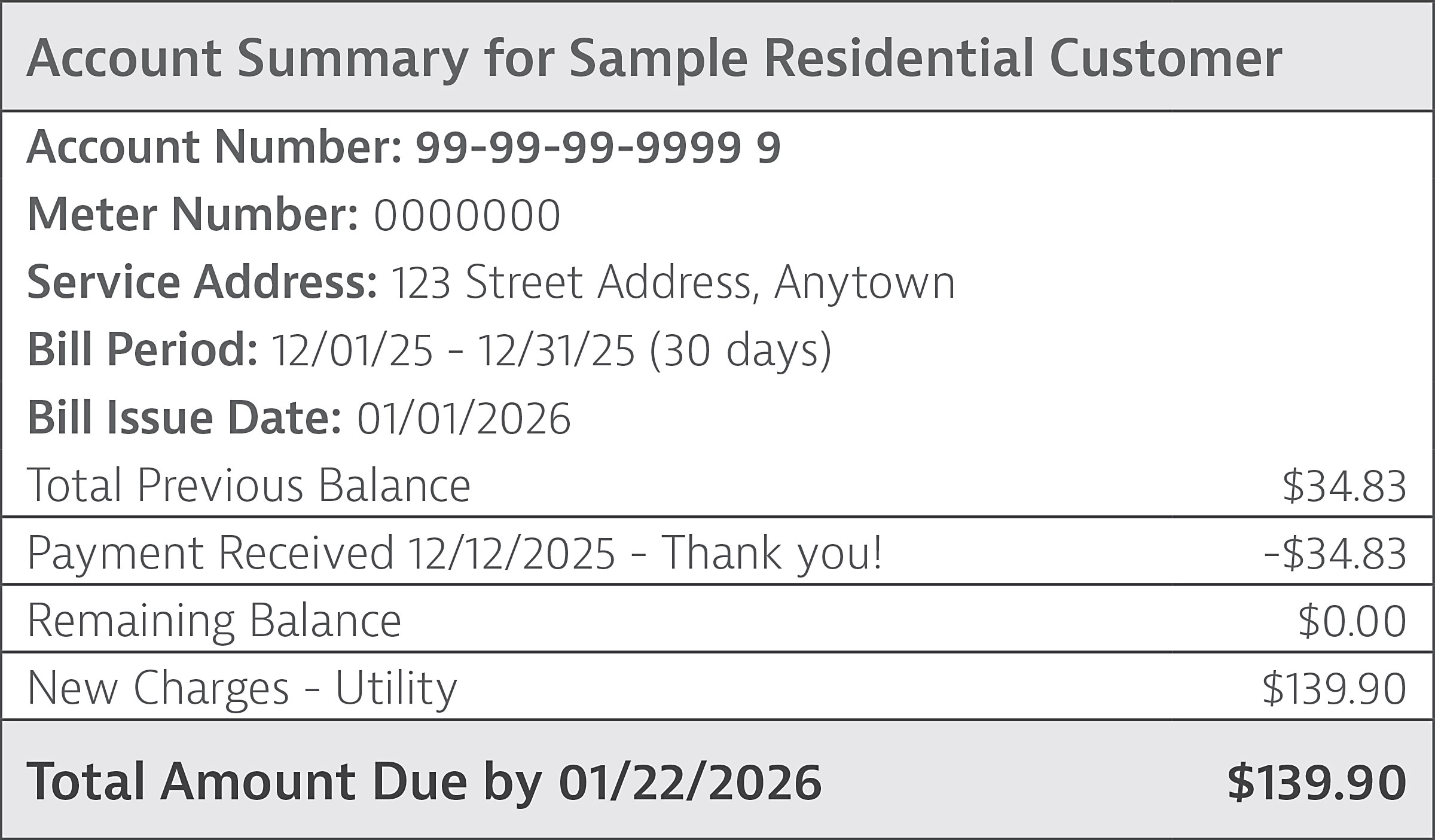

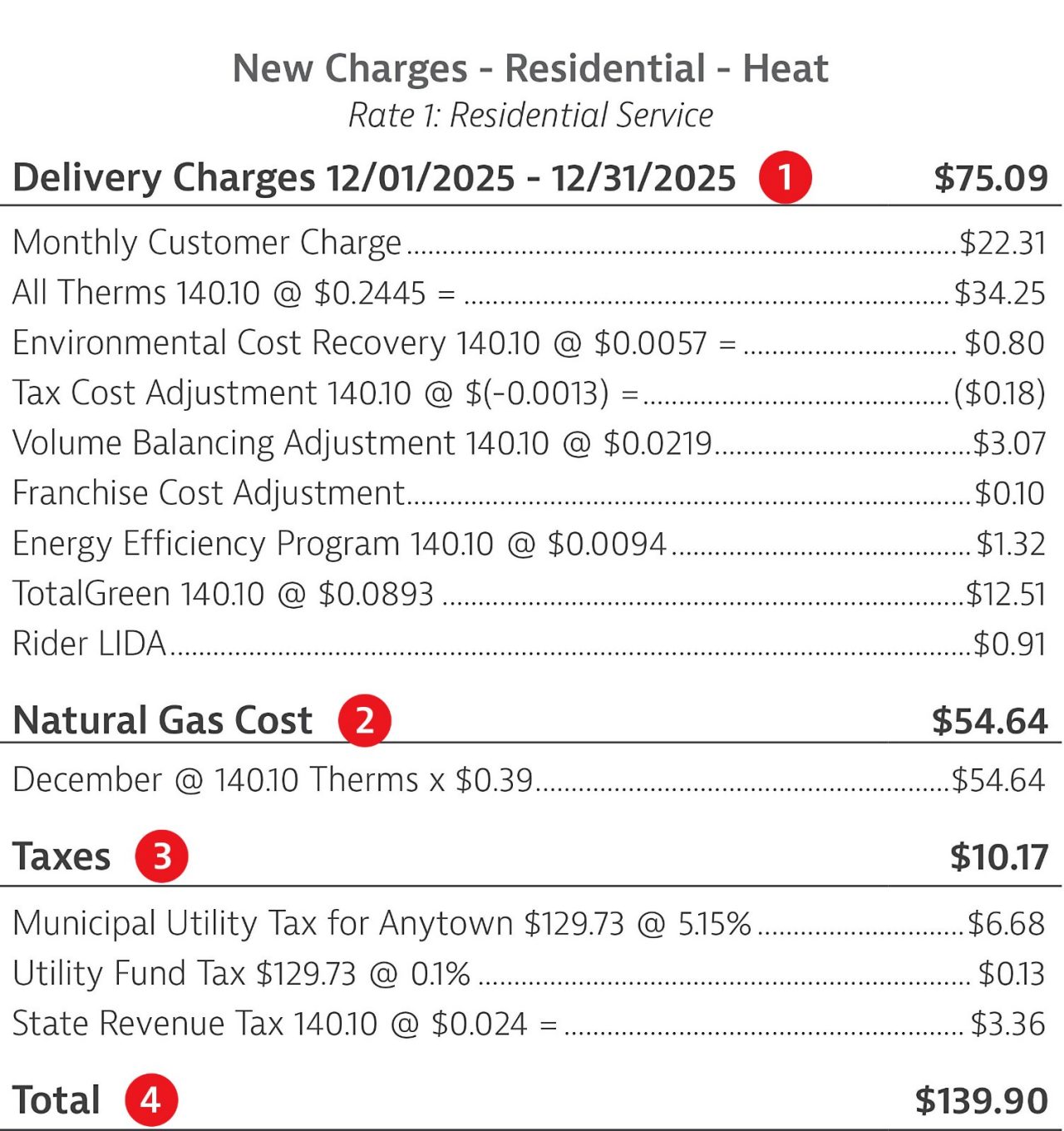

Account Summary

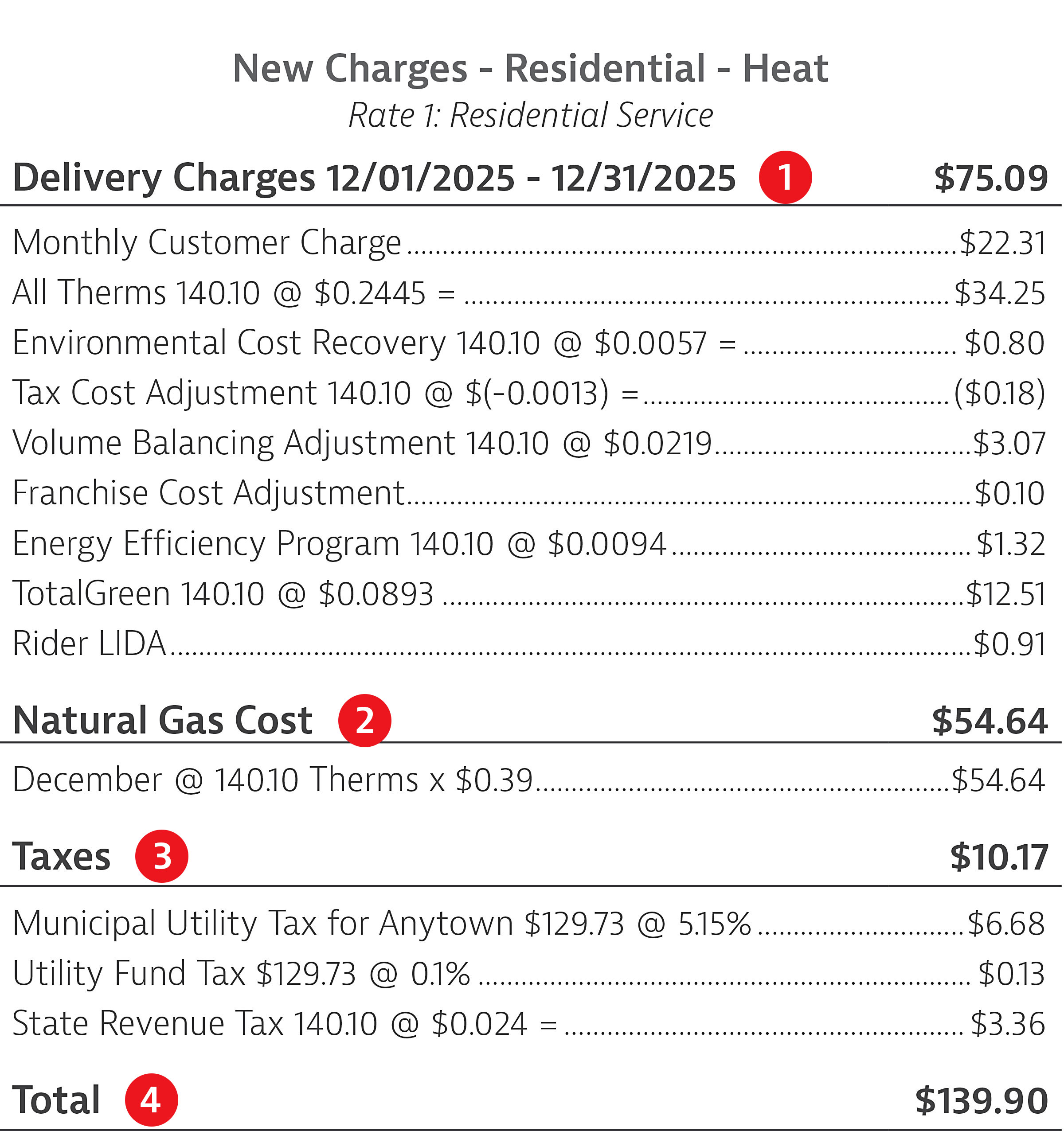

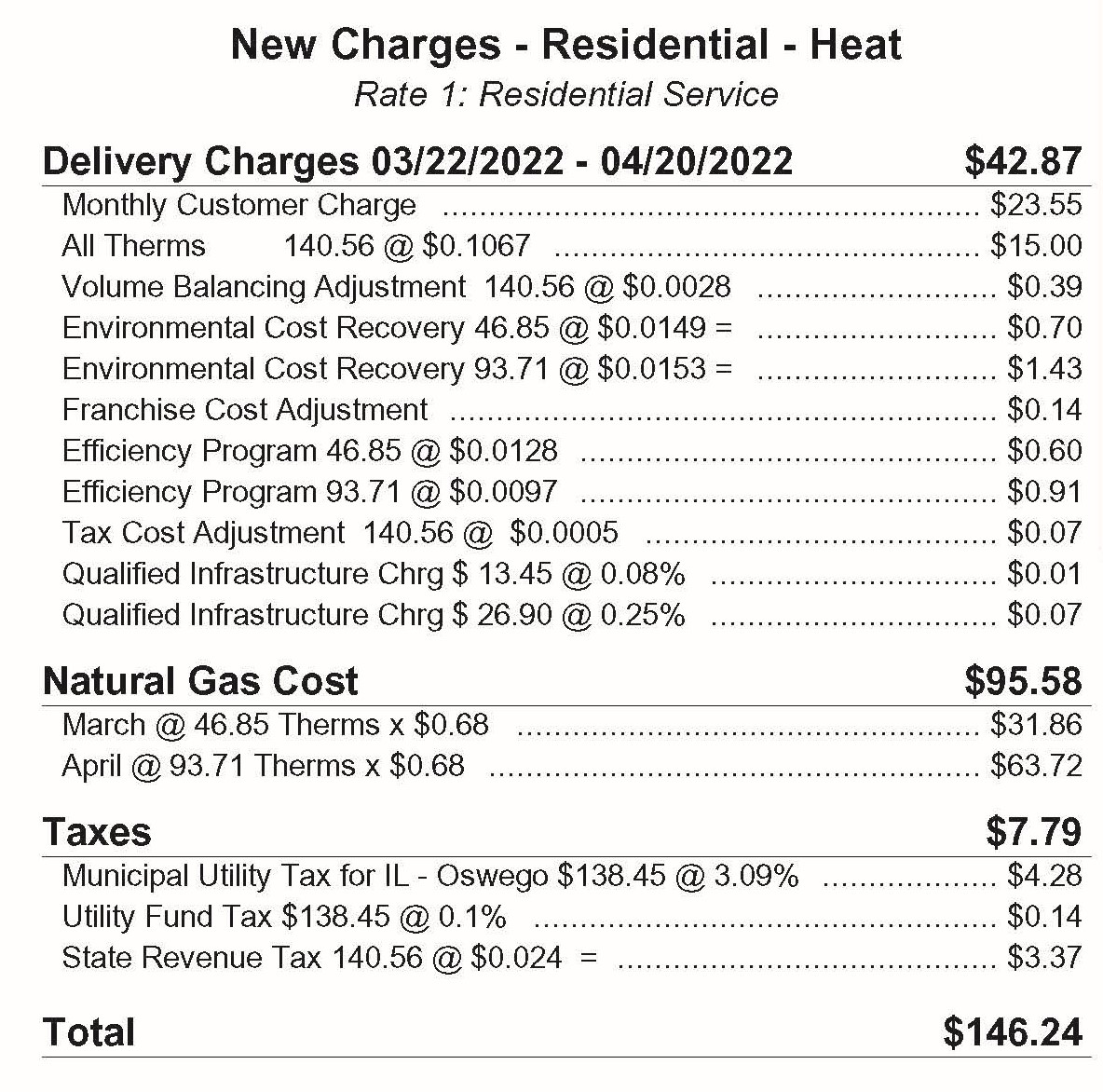

New Charges

Delivery Charges

Monthly Customer Charge – a fixed amount that covers our expenses to read your meter, produce your bill and other monthly administrative costs. A small portion of this charge covers various taxes. This charge is incurred even if no gas is used.

Distribution Charges – covers our operating and distribution costs. These charges vary monthly based on the amount of natural gas you use.

Environmental Recovery Cost – covers our cost for the environmental monitoring and clean-up of former manufactured gas facilities. This cost changes periodically, and Nicor Gas does not profit from these charges.

Franchise Cost – covers our cost for municipal franchise agreements. Nicor Gas does not profit from this charge.

Governmental Agency Adjustment – an adjustment for governmental fees and added costs, excluding franchise costs. This cost changes periodically, and Nicor Gas does not profit from these adjustments.

Efficiency Program Charge (Effective June, 2009) – pays for costs related to energy efficiency programs. Nicor Gas does not profit from this charge.

Qualified Infrastructure Charge – To pay for the costs of qualified infrastructure investments allowed under Section 9-220.3 of the Public Utilities Act.

Natural Gas Charges

Natural gas costs make up approximately half of your Nicor Gas bill. This is the charge for the gas you use during the billing month. It is calculated by multiplying your gas usage by the average cost per therm we pay to purchase gas supplies. The amount you pay varies monthly based on the cost of gas and the amount you use. Nicor Gas does not profit from gas costs; we pass our cost on to you without markup.

Taxes

Taxes are levied by the State of Illinois and various local municipalities. There are several taxes that may be associated with your natural gas bill, including:

State Revenue Tax – a tax mandated by the state.

Utility Fund Tax – mandated by the state, this tax funds the Illinois Commerce Commission (ICC), which regulates all Illinois utilities.

State Use Tax – a tax for gas purchased outside Illinois for use in Illinois.

Municipal Utility Tax – some municipalities charge a tax based on utility revenues and apply according to the municipality's local ordinance.

Municipal Use Tax – some municipalities charge this tax based on your gas usage.

Total

This is a sum of all charges for the month.

A Message for You

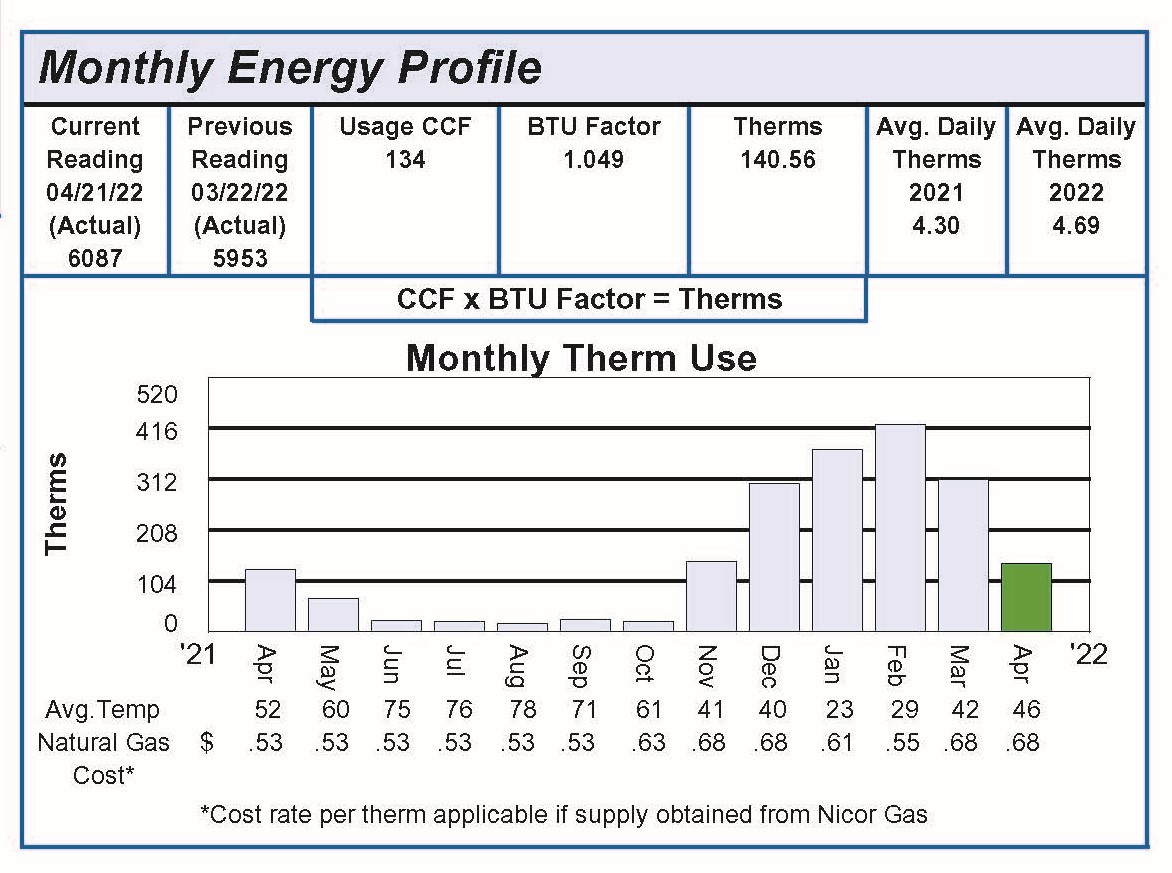

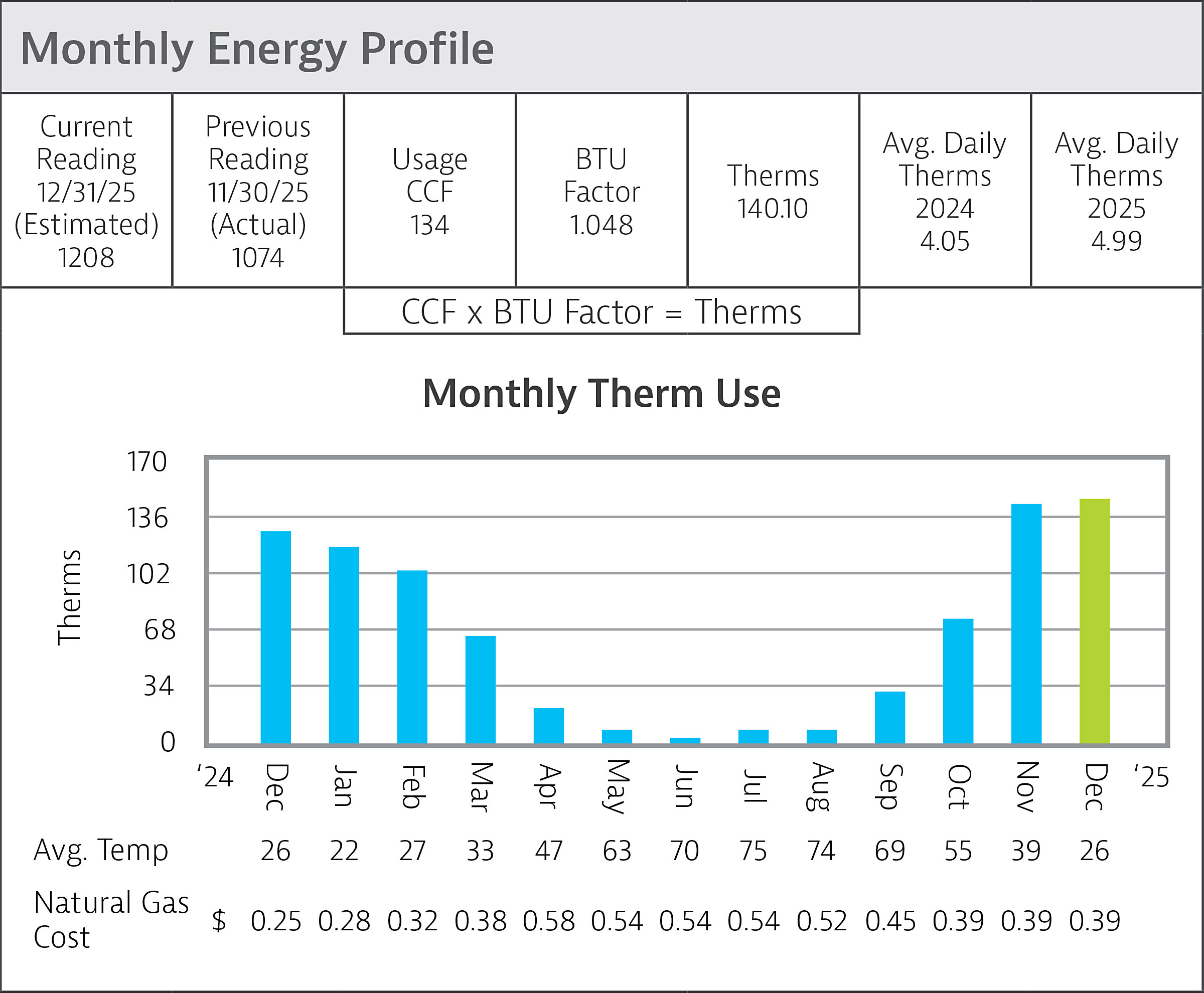

Monthly Energy Profile

Description: This is an enhanced look at your gas use over the last 13 months, with specifics on consumption, meter reading information, the cost of gas and average temperature.

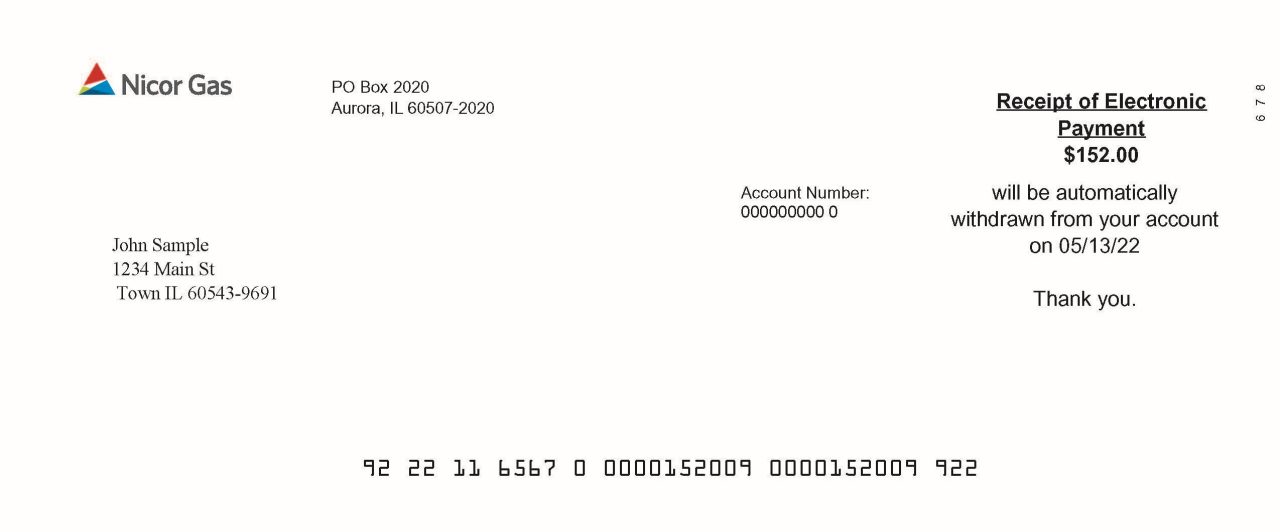

Payment Stub

Description: This section includes your address, account number you will use when logging into your account portal or when you contact customer service and your bill total for the month.